Table of Contents

Overview of the Current Crisis

The world’s chaos is hitting pretty much every industry, but Brazil on cocoa plan? it’s feeling the heat big time. Climate change, it’s messing with harvests, prices are doing their usual rollercoaster thing, and people’s chocolate cravings keep changing. Farmers in the old-school cocoa zones are sweating bullets, watching millions of seedlings teeter on the edge. And don’t think the big chocolate companies aren’t lurking, waiting to see if Brazil can hold its ground or if someone else is about to snatch their spot. It’s a wild ride, and honestly, Brazil’s got its work cut out if it wants to stay in the global cocoa game.

Potential for Growth and Innovation

Assuming Brazil leverages its agricultural expertise, there exists considerable potential for growth and innovation in the cocoa sector. With investments in sustainable farming practices and advancements in agro-technology, Brazilian farmers can increase yield while improving the quality of their cocoa beans, positioning the country as a leader in the market.

Potential growth avenues lie in Brazil’s ability to innovate through sustainable cultivation methods and technological advancements. By adopting precision agriculture and enhancing farming practices, people can boost crop yields while ensuring environmental sustainability. Additionally, tapping into the increasing global demand for ethically sourced cocoa products can enable Brazil to differentiate itself within a competitive landscape. Unlike Indonesia, which is also vying for a prominent place in the cocoa market, Brazil’s geographical advantages and commitment to sustainability may prove critical in its journey to becoming the world’s leading cocoa plantation.

- Witty Take & Analysis

Can Brazil really displace traditional cocoa giants like Ivory Coast or Ghana, not to mention Indonesia? While they hold promise with millions of seedlings waiting, Brazil’s ambition may hinge on effective crisis management and innovation. Indonesia, the world’s third-largest producer, showcases a model of efficiency yet grapples with sustainability issues. To stay competitive, Brazil could adopt Indonesia’s aggressive techniques in scale while embedding environmental consciousness into its strategy, favoring both growth and market appeal. In short, the road to cocoa dominance will be paved with both seedlings and smart strategies.

Impact on agriculture and sustainability

Brazil’s gunning for the top spot in cocoa production, and honestly, they’re not just winging it. There’s a big push for eco-friendly farming—no more trashing the land just to crank out more chocolate. If they play their cards right, not only will they get bigger harvests, but the soil and all those critters actually stand a chance. Makes the farms tougher, too, especially when the weather goes nuts (which, let’s be real, is basically every other week now). As Brazil ramps up those cocoa seedlings, the way they’re handling things could totally set the bar for everyone else. Responsible chocolate? Sign me up.

Future prospects for seedling production

The prospects for seedling production in Brazil appear promising as the country intensifies its efforts to enhance cocoa cultivation. By increasing investment in research and development, Brazilian producers aim to improve seedling quality and diversification, which are crucial for meeting both domestic and international market demands. Enhanced seedling production also supports long-term sustainability goals, ensuring that future cocoa farms are well-equipped to thrive in varying climatic conditions.

Agriculture in Brazil stands at a turning point, with innovative strategies paving the way for a more competitive stance in the global cocoa market. By focusing on high-yield varieties and sustainable practices, Brazil can potentially increase its cocoa output significantly, competing with the likes of Ghana and Côte d’Ivoire. Moreover, these advancements could position Brazil as a trendsetter in agricultural sustainability, attracting environmentally-conscious consumers worldwide.

Brazil is aiming to become the leading producer of cocoa beans on 2030, with a strategic focus on increasing seedling production while maintaining sustainability. This approach could enhance both productivity and environmental consciousness in Brazilian agriculture.

- Analysis

Brazil’s ambitious goal to become the top global producer of cocoa beans is an exciting proposition. Currently, countries like Côte d’Ivoire and Ghana dominate the market, with Indonesia also emerging as a significant player. They have established robust supply chains and have invested in research and development to enhance yield and disease resistance in their cocoa crops. Brazil’s challenge will not only be to catch up but to forge a distinct identity as a sustainable producer.

Should Brazil succeed, it will not only reshape its agricultural landscape but potentially shift global market dynamics. For Indonesia, this competition could be a catalyst to further improve their own strategies. Emphasizing sustainability, enhancing farmer training, and investing in technology could solidify Indonesia’s standing in the cocoa sector. A focused approach could be the key to thriving amidst Brazil’s budding ambitions.

Industry Trends and Monitoring

Brazil basically gunning for the top spot in cocoa, right? They’re not just planting more seedlings left and right—they’re also glued to the latest market drama. Big chocolate companies are lurking, waiting to pounce on any new opportunity in up-and-coming regions. So, yeah, whatever Brazil does next could totally mess with what people expect from the cocoa market. Plus, there’s a good chance they’ll set some trends for how the whole industry talks about trade and sustainability.

Implications for Cocoa Farmers

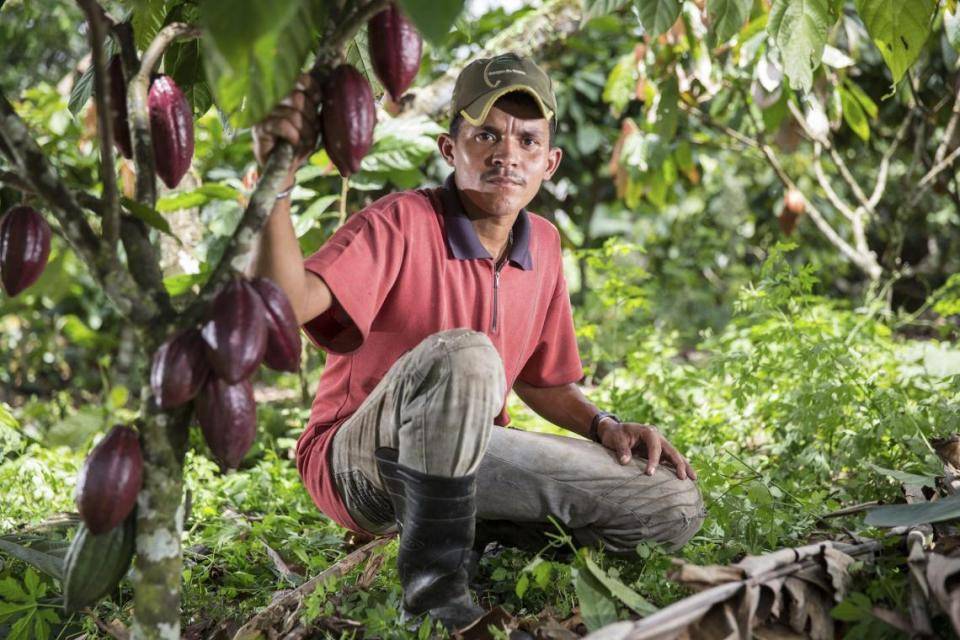

Cocoa farmers in Brazil stand to benefit from the nation’s ambitious strategy aimed at enhancing production and competitiveness. As investments in infrastructure and training increase, they may have better access to resources and cutting-edge farming techniques. This shift could lead to higher yields, more sustainable practices, and ultimately, improved livelihoods for cocoa farmers.

Industry developments suggest that improvements in technology and farming practices will enable cocoa farmers to optimize their production. With substantial government backing and an emphasis on sustainability, he or she may see increased income through higher quality crops and better access to international markets. As Brazil expands its cocoa operations, they must prioritize competitive pricing and ethical sourcing to maintain a strong position against established cocoa-producing countries such as Ivory Coast and Ghana, alongside rising players like Indonesia.

To bolster its position, Indonesia could benefit from enhancing farmer education on sustainable practices and focusing on specialty cocoa markets that emphasize quality over quantity. This approach would not only improve farmers’ profitability but also secure Indonesia’s reputation in the premium cocoa segment. Emphasizing technology, better export strategies, and value-adding practices could help Indonesia maintain and possibly grow its market share in the global cocoa arena.

- Challenges facing the agricultural sector

Any ambitions to dominate the cocoa industry face significant challenges, notably climate change, deforestation, and market volatility. As Brazil seeks to ramp up its production, he and she must navigate the risks posed by these environmental factors, which could undermine the sustainability of cocoa plantations. The scrutiny from global players, particularly Big Cocoa, adds another layer of complexity, as they closely monitor Brazil’s strategies and practices in agricultural production.

Strategies to mitigate risks

Sector stakeholders are implementing various strategies to mitigate risks associated with agricultural production. This includes adopting sustainable farming practices, investing in technology to optimize yield, and diversifying crops to reduce dependency on cocoa alone. By fostering partnerships with international buyers and certification bodies, they aim to ensure that Brazilian cocoa meets global sustainability standards, ultimately enhancing its market competitiveness.

Plus, comprehensive training programs for farmers on sustainable techniques and financial management could be key in bolstering the sector. By increasing productivity while minimizing environmental impact, Brazil can position itself favorably in the international market. People also encouraged to explore agroforestry systems, integrate pest management, and leverage crop insurance to protect against inclement weather or price fluctuations. These strategies not only enhance resilience but may also attract investment in an increasingly eco-conscious marketplace.

Brazil is on a quest to become the leading producer of cocoa beans, aiming to capitalize on its resources and agricultural expertise. However, it faces challenges, including environmental concerns and significant competition from established producers like Ivory Coast and Ghana, as well as emerging competitors like Indonesia.

Witty Analysis: Can Brazil really seize the crown in the cocoa kingdom? With its strategic plans in place, the country seems poised for a cocoa renaissance, but against the backdrop of heavyweights like Ivory Coast and Ghana, competition will be fierce. Moreover, Indonesia’s strategic advances in cocoa farming and sustainability may pose an unexpected hurdle for Brazil. While Brazil may have the ambition, it remains to be seen whether it can match Indonesia’s efficiency and innovation in cocoa production, especially given Indonesia’s focus on improving yield and sustainability.

Suggestions for Indonesia’s Cocoa Strategy: To further bolster its position in the cocoa market, Indonesia could enhance its focus on research and development in hybrid cocoa varieties that are more resilient to disease and climate shift. Investing in better infrastructure for farmers, such as training programs on sustainable practices, will not only increase yield but also raise the quality of cocoa, making it more competitive internationally. Additionally, fostering cooperative frameworks could enhance bargaining positions in global markets.

- Key insights from experts

You would find that industry experts warn of both opportunities and challenges as Brazil seeks to dominate the cocoa market. They highlight that while Brazil has the potential to produce millions of seedlings, strategic planning and sustainability will be vital. Additionally, experts suggest that big cocoa companies are closely monitoring Brazil’s advancements, which may influence global market dynamics.

Brazil on Cocoa Plan: Upcoming trends in markets

Little attention has shifted towards emerging market cocoa production as Brazil aims to enhance its standing in the global market. Experts anticipate that trade dynamics will evolve, with Brazil potentially reshaping supply chain relationships and influencing price trends for cocoa beans.

This shift aligns with broader economic conversations stemming from rising debt issues in other emerging markets. As Brazil improves its cocoa output, the international agricultural landscape may adjust, with Brazil and Indonesia at the forefront of this transformation. The World Bank’s chief economist asserts that cutting tariffs could invigorate trade and ultimately benefit not only Brazil but also other producing nations like Indonesia.

When all is said and done, Brazil is positioning itself to become a leading force in cocoa production, with plans to expand seedling growth amidst increasing scrutiny from major stakeholders in the cocoa industry. Nevertheless, challenges persist. With Indonesia also emerging as a significant cocoa producer, Brazil’s ambitious goal will hinge on its capacity to innovate sustainably while navigating complex market dynamics and possible risks. Indonesia’s strategy could benefit from focusing on enhancing quality and diversifying cocoa products, potential synergies in trade partnerships, and investing in sustainable farming practices to bolster its competitive edge.

Conclusion

Can Brazil actually snatch the cacao crown? Honestly, the country’s got guts and some new ideas, but come on—Ivory Coast and Ghana aren’t just going to roll over. Those two have been running the show for ages. And let’s not forget Indonesia, quietly leveling up its game while everyone’s busy staring at Africa. Brazil talks a big game about going green and shaking up the industry, but breaking into those old-school supply chains? Not exactly a walk in the park. Meanwhile, Indonesia’s out here upgrading farms and getting their shipping sorted. If Indonesia really wants to climb the ladder, maybe it should double down on quality control and buddy up with the big cocoa processors.